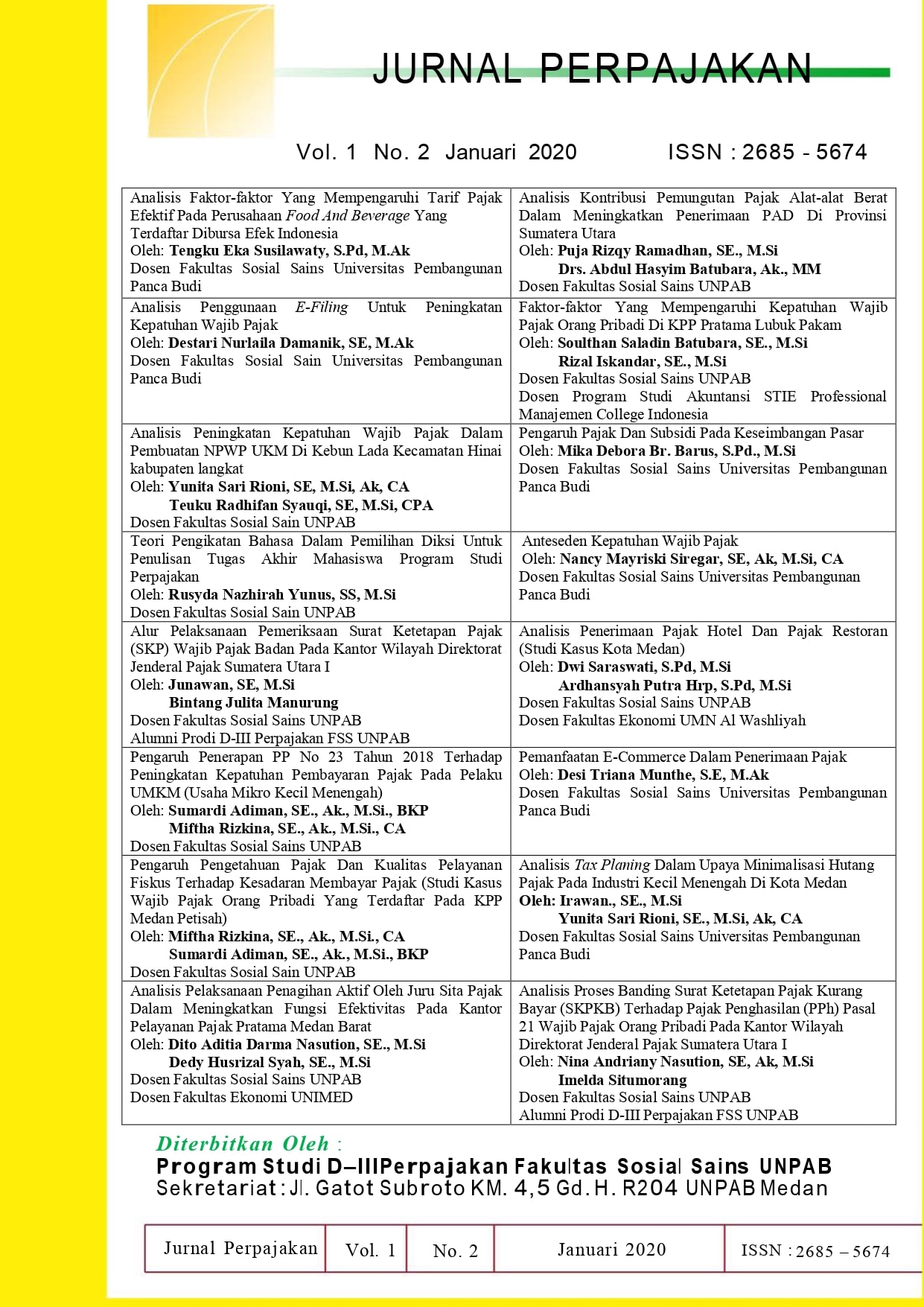

ALUR PELAKSANAAN PEMERIKSAAN SURAT KETETAPAN PAJAK (SKP) WAJIB PAJAK BADAN PADA KANTOR WILAYAH DIREKTORAT JENDERAL PAJAK SUMATERA UTARA I

Junawan; Bintang Julita Manurung;

Abstract

The tax regulations issued by the government as the implementation of the tax law are quite a lot, both those that change the provisions that already existed before and those that make new provisions. Everything is for firmness, clarity, and legal certainty. Through the implementation of the examination it can be seen whether the individual taxpayer or entity has implemented tax compliance with its tax obligations in accordance with the applicable tax regulations. Taxpayer's noncompliance from time to time increases. This research is carried out through tax audit which is an activity of seeking, collecting, processing data and / or other information to test compliance with the fulfillment of tax obligations and other purposes in order to implement the provisions of tax laws and regulations. The implementation of this tax audit begins with an Inspection Order (SP2) and continues with borrowing documents, carrying out tests, Issuance of Inspection

Results (SPHP) and closing conference. Each audit flow is regulated as well as the rights and obligations of the Taxpayer and the Examiner so that fairness occurs during the inspection process. In the process of implementing the Taxpayer has the right to see SP2, is obliged to lend documents, receive SPHP submission,

closing conference, hold discussions with the QA Team and fill out questionnaires. In the report section, the steps taken are making the Audit Report (LHP) as a reference as the basis for issuing a Tax Assessment Letter (SKP) at the North Sumatra Regional Office of the Directorate General of Taxes I. As for the obstacles in the implementation of tax audits such as, Taxpayers who move their address without being identified by their new address by the examiner, in this case do not report to the local village head so that the examiner is hampered and the taxpayer is not cooperative.